Best Same Day Payday Loans for Quick Cash in 2025: MoneyMutual Picked as the Top Pick for Guaranteed Approval

Las Vegas, NV, May 21, 2025 (GLOBE NEWSWIRE) --

In today’s unpredictable economy, financial emergencies rarely come with a warning. A sudden car repair, medical bill, or missed paycheck can send even the most prepared households into a scramble. In such moments, speed isn't just convenient, it's essential.

As Americans increasingly turn to fast, flexible lending options, the demand for same-day payday loans has surged. Just as we expect rapid food delivery and real-time updates, financial solutions must also keep pace. Consumers want cash in hand, not tomorrow, but today.

Amid a crowded field of lenders and brokers, MoneyMutual has emerged as the leading online platform connecting borrowers with trusted same-day payday loan providers. Recognized for its efficiency, wide lender network, and secure process, MoneyMutual stands out as the top choice for those seeking fast financial relief in a pinch.

Stay with us as we take a closer look at how MoneyMutual works and why it's become the go-to resource for same-day lending solutions in 2025.

>> Consider MoneyMutual for Same Payday Loans >>

Overview of the Leading Same Day Payday Loan Connection Service – MoneyMutual

When time is of the essence and financial relief can’t wait, MoneyMutual stands at the forefront of same-day payday loan connection services. With a reputation built on speed, simplicity, and trust, the platform offers a fast and accessible route for borrowers seeking immediate financial support.

Speed of Potential Funding: One of MoneyMutual’s standout features is its ability to facilitate rapid access to funds, often as soon as the same business day. After submitting a short application, borrowers are swiftly connected with a lender from the platform’s expansive network. If approved, funds can be deposited directly into the applicant’s bank account within hours, depending on the lender’s processing times and bank policies.

Extensive Lender Network: MoneyMutual doesn’t issue loans directly. Instead, it acts as a trusted intermediary, linking users to an array of verified online payday lenders. This expansive network increases the chances of loan approval by matching borrower needs with the criteria of various lending partners.

>> Visit MoneyMutual to Find Out More >>

Key Evaluation Factors

To determine why MoneyMutual stands out among same-day payday loan connection services, several key factors were assessed, from lender quality to user experience.

Quality and Size of Lender Network

MoneyMutual partners with over 60 lenders, ranging from specialized payday providers to short-term installment loan companies. These are vetted for reliability and compliance, offering borrowers a better shot at finding a match tailored to their financial situation.

Accessibility of Loan Options

The platform supports a broad range of loan amounts, typically between $100 and $5,000, depending on individual lender terms and borrower qualifications. This flexibility accommodates everything from small emergencies to more urgent, moderate expenses.

Potential for Rapid Funding

Once connected with a lender, borrowers may receive funds as quickly as within 24 hours, and in some cases, the same day. This makes MoneyMutual a highly attractive option for those facing time-sensitive financial stressors.

Platform Usability

The MoneyMutual website is designed for ease and efficiency, featuring mobile compatibility and streamlined navigation. Borrowers can apply, review offers, and connect with lenders all within minutes.

Simple Application Process

Filling out MoneyMutual’s secure online form typically takes under five minutes. Applicants provide basic information about their income, employment status, and banking details. Once submitted, the platform immediately begins matching them with potential lenders.

Features for Borrowers

MoneyMutual allows users to compare loan offers from multiple lenders in one place. This increases transparency and empowers users to select the option that best meets their needs.

Transparency of Lender Terms

While MoneyMutual itself doesn’t dictate terms, it emphasizes partnerships with lenders that clearly disclose loan amounts, repayment dates, APRs, and fees, a crucial feature in helping borrowers make informed decisions.

Ease of Navigation

The website features a clean, modern interface with clear calls-to-action and informative content. Even first-time users will find it intuitive to use on desktop or mobile.

Typical Loan Parameters

Loan amounts facilitated through MoneyMutual generally range from $100 to $5,000, with repayment periods often between 14 and 30 days, depending on the lender and state regulations. Some lenders may offer extended terms for installment loans.

>> Consider MoneyMutual for Same Payday Loans >>

Pros and Cons of MoneyMutual for Same Day Payday Loans

In a financial climate where speed often matters most, MoneyMutual has emerged as a go-to marketplace for borrowers seeking same day payday loans. But how does it really stack up? We take a closer look at the platform’s key advantages and potential drawbacks as more Americans turn to short-term lending for emergency expenses.

Pros:

- Potential for Fast Fund Access: Many users report receiving funds as soon as the next business day, sometimes even within hours, depending on the lender.

- Large Network of Participating Lenders: MoneyMutual connects users with a broad pool of lenders, increasing the chances of finding a match, even with less-than-perfect credit.

- Streamlined Online Application Process: The initial form takes just minutes to complete, making it ideal for time-sensitive borrowing needs.

- User-Friendly Online Platform: The website is simple to navigate, guiding applicants from inquiry to lender match with minimal friction.

- Opportunity to Compare Multiple Loan Offers: Users can review different offers and select terms that best align with their needs before committing.

Cons:

- MoneyMutual Is Not a Direct Lender: The platform acts as a facilitator, meaning users must evaluate and finalize terms with third-party lenders independently.

- Loan Terms and Interest Rates Vary by Lender: APRs, repayment windows, and fees differ widely, and borrowers must scrutinize each offer carefully.

- Payday Loans Typically Involve High Interest Rates and Fees: Even when fast cash is needed, these loans can become costly, especially if rolled over or extended.

How to Utilize MoneyMutual for Potential Same Day Payday Loans

As financial pressures grow for millions of Americans, platforms like MoneyMutual are seeing increased usage from borrowers in need of quick cash. Here’s how consumers can navigate the service to potentially access same day payday loans.

Step-by-Step Process:

- Visit the Official MoneyMutual Website: Begin by going to MoneyMutual.com, where users can start the loan inquiry process directly from the homepage.

- Complete the Secure Online Application Form: Applicants are asked to enter basic personal and financial information. The form typically takes just a few minutes and is encrypted to protect sensitive data.

- Review Loan Offers from Lenders in the Network: Once submitted, the system distributes the application to a network of participating payday lenders. Eligible borrowers may receive multiple offers to compare.

- Examine Terms and Conditions Carefully Before Accepting: Each lender sets its own rates, fees, and repayment requirements. Experts caution that borrowers should read all terms closely and ensure they understand the total repayment cost before agreeing to any loan.

With no obligation to accept an offer, MoneyMutual serves as a free intermediary rather than a direct lender. However, borrowers should be aware of state-specific payday loan regulations and consider all financial alternatives before proceeding.

Types of Short-Term Financial Assistance Facilitated by MoneyMutual

As rising costs and inflation strain household budgets, Americans are increasingly turning to alternative lending platforms for fast, flexible cash solutions. Among them, MoneyMutual has gained traction as a major online marketplace that connects borrowers with lenders offering a variety of short-term financial products. While the platform itself isn’t a direct lender, it facilitates access to multiple loan types tailored for immediate financial relief.

Here’s a closer look at the key types of loans available through the MoneyMutual network:

- Payday Loans: These are brief, high-cost loans intended to cover expenses until the borrower’s next paycheck. Loan amounts are typically small, often between $100 and $1,000, but carry high interest rates and fees. While controversial due to their cost, payday loans remain a common solution for those facing sudden emergencies like utility shutoff notices or medical expenses.

- Short-Term Loans: This broader category includes installment loans and other forms of lending with short durations, usually ranging from a few weeks to several months. These loans may offer slightly more favorable repayment terms than traditional payday loans and can be used for a variety of needs, such as auto repairs, rent payments, or temporary income disruptions.

- Bad Credit Loans: For borrowers with low credit scores or limited credit history, MoneyMutual helps facilitate access to lenders willing to work with higher-risk applicants. These loans come with elevated interest rates but offer a vital financial lifeline to consumers often excluded from traditional banking systems.

- Cash Advances: Cash advances are designed for rapid disbursement, sometimes within 24 hours, and are ideal for extremely time-sensitive expenses. Typically repaid from the borrower’s next paycheck, these loans are often used to bridge the gap between pay periods or when an unexpected cost arises.

While these financial products can offer short-term relief, experts caution they should be used carefully. Borrowers are urged to read loan terms closely, understand all associated fees, and assess whether repayment timelines align with their income schedule. Platforms like MoneyMutual may provide access, but financial responsibility lies squarely with the borrower.

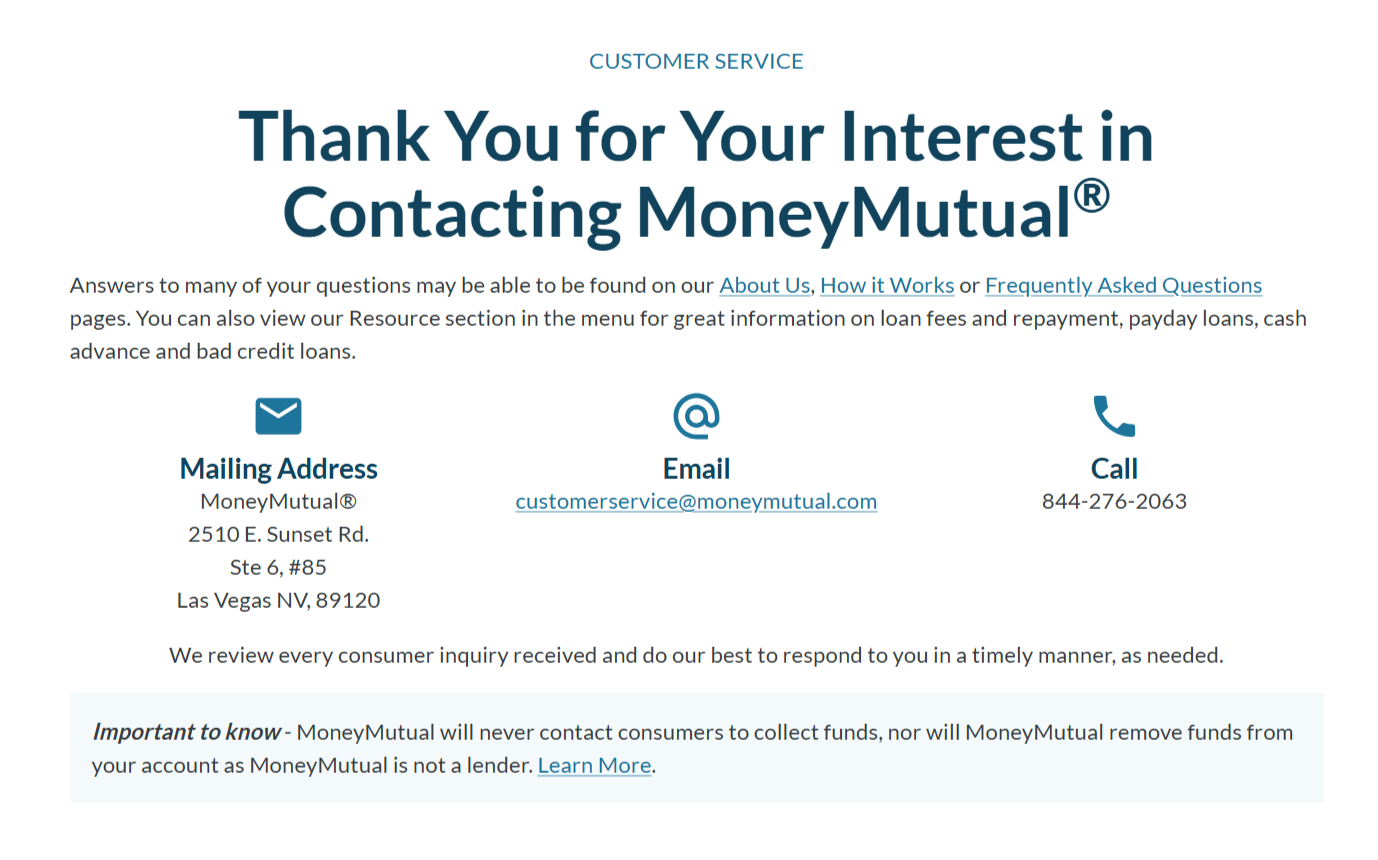

Customer Support and Resources Offered by MoneyMutual

As more consumers turn to online lending marketplaces for fast financial relief, support and transparency have become increasingly important. MoneyMutual offers a basic but functional support system designed to guide users through the lending process.

Unlike direct lenders, MoneyMutual serves as an intermediary, connecting users with its network of more than 60 short-term lenders. Because of this, its customer support doesn’t extend to loan management or repayment issues, which must be handled directly with the individual lender. However, the platform does provide users with access to key resources that help clarify how the loan matching process works.

The company maintains a comprehensive FAQ section on its website, offering clear answers to common questions about eligibility, the loan request process, credit requirements, and fund disbursement. The site also outlines what borrowers can expect after being matched with a lender and encourages users to review terms carefully before signing any agreement.

The platform doesn’t offer live chat or in-depth financial education tools, it emphasizes its role as a free service to connect borrowers with loan offers, placing the responsibility of further communication and decision-making on the user.

Potential Disbursement Methods Through MoneyMutual’s Network

As more consumers turn to online lending platforms for fast financial relief, how those funds are delivered becomes just as critical as loan approval itself. MoneyMutual, one of the most recognized payday loan marketplaces, connects borrowers with a wide range of lenders, each offering different methods of disbursing funds.

- Direct Deposit to Bank Account: The most widely used and efficient method among lenders in the MoneyMutual network is direct deposit. Once approved, borrowers may receive funds directly into their checking account, often within 24 hours. For many facing urgent expenses, this speed and convenience are a significant advantage.

- Other Methods (Varies by Lender): While direct deposit remains the standard, some lenders may offer alternative electronic disbursement options, such as ACH transfers or prepaid debit card funding. However, availability can vary by lender and borrower location, and these alternatives may affect how quickly funds are accessible.

Borrowers using MoneyMutual should confirm disbursement methods and timelines directly with their matched lender to ensure there are no delays in accessing their funds.

Navigating Same Day Payday Loans Responsibly: Important Cautions

Same day payday loans can serve as a financial lifeline in moments of crisis, but they must be approached with caution. The high interest rates, short repayment terms, and risk of repeat borrowing make them a risky option for most consumers.

By understanding the costs, reading loan terms carefully, and seeking alternative financial solutions where possible, borrowers can protect themselves from unnecessary financial hardship. Responsible borrowing begins with informed decision-making, and when in doubt, seeking professional financial guidance is always a wise move.

Understand the High Costs

Same day payday loans may provide fast funds, but they are among the most expensive forms of borrowing available. These loans typically carry high interest rates, with annual percentage rates (APRs) that can reach or exceed 300%.

In many cases, the fees and interest owed may be nearly as much as the original loan amount. For example, borrowing $300 could cause repaying $375 or more in just two weeks. Without a clear repayment strategy, the costs can escalate quickly, especially if the borrower is forced to extend or roll over the loan.

Review Loan Terms Carefully

Payday loans are legally required to disclose all terms and fees, but borrowers often overlook the fine print. Each lender may have different repayment policies, fees for late or missed payments, or clauses that allow for automatic withdrawal from a borrower’s checking account.

Carefully reviewing these terms before accepting a loan is essential. Understanding the total repayment amount, due date, and what happens if repayment is delayed can help prevent surprises and avoid spiraling fees.

Borrow Only What You Can Repay

It may tempt you to borrow the maximum amount offered, especially when facing financial stress. However, payday loans are due in full within a short timeframe, usually on your next payday. Borrowing more than you can reasonably afford to repay can quickly result in bounced payments, overdraft fees, or the need to take out additional loans.

A good rule of thumb is to borrow the minimum amount needed and ensure that full repayment can be made from your next paycheck without jeopardizing other essential expenses.

Be Aware of Short Repayment Periods

Unlike personal loans or credit cards that allow for flexible monthly payments, payday loans are typically due in a lump sum within 14 to 30 days. This compressed repayment window can strain already tight budgets.

Missing the repayment deadline can trigger additional fees and result in a cycle of borrowing and debt accumulation. Many borrowers find themselves having to take out new payday loans just to cover the previous ones, further increasing financial stress.

Consider Alternatives First

Before committing to a payday loan, it’s worth exploring other, less expensive borrowing options. Credit unions often offer Payday Alternative Loans (PALs), which feature lower interest rates and longer repayment periods. Some banks provide small-dollar personal loans with predictable terms.

Other alternatives include negotiating payment plans with utility companies, seeking temporary hardship assistance from local nonprofits, or utilizing buy now, pay later services for specific purchases. These alternatives may not offer instant cash, but they typically come with fewer long-term risks and better repayment flexibility.

Recognize the Risk of Debt Traps

One of the most concerning aspects of payday loans is the potential for borrowers to fall into a debt trap. Many payday loan users find themselves unable to repay the full balance on time and must take out another loan to cover the previous one. This cycle of borrowing and repayment often continues for months, with fees compounding at every step.

Over time, a small loan can grow into a major debt burden, affecting a borrower’s ability to meet other financial obligations and damaging their overall financial stability.

Seek Financial Advice if Needed

For those considering payday loans or currently struggling with repayment, seeking help from a financial advisor or credit counselor can be a valuable step. Nonprofit credit counseling agencies offer free or low-cost services that include budgeting support, debt management plans, and guidance on safer borrowing options.

Some states and local governments also provide financial education programs to help consumers better understand loan terms and credit usage. Accessing these resources can provide long-term financial strategies that reduce reliance on high-cost, short-term loans.

Frequently Asked Questions

If you're considering a same-day payday loan, it's important to understand exactly how these loans work, what they cost, and what to expect from the process. Below are answers to the most common questions borrowers ask before applying.

What Is a Same-Day Payday Loan?

A same-day payday loan is a short-term, high-interest loan designed to give borrowers quick access to cash, usually on the same day they apply. These loans are used to cover urgent expenses such as medical bills, car repairs, or unexpected utility payments. The loan amount is usually small (often between $100 and $1,000) and must be repaid in full on your next payday, usually within two to four weeks.

How Quickly Can I Get the Money?

If approved, many lenders can deposit funds into your bank account within a few hours or by the end of the business day. However, actual timing depends on when you apply, the lender’s processing speed, and your bank’s deposit policies. Some lenders offer instant funding or same-day direct deposit if applications are submitted early in the day, while others may require overnight processing.

Do I Need Good Credit to Get a Same-Day Payday Loan?

No, same-day payday loans are generally accessible to borrowers with poor credit or no credit history at all. Most lenders don’t perform hard credit checks and instead focus on your income, employment status, and ability to repay the loan. Proof of a steady income, a valid ID, and an active checking account are typically the main requirements for approval.

What Are the Costs Associated With Same-Day Payday Loans?

Same-day payday loans can be very expensive. While the fees may seem modest upfront, the annual percentage rates (APRs) can reach 300% or more. For example, a $300 loan with a $45 fee for two weeks equates to a 391% APR. Failing to repay the loan on time can lead to additional fees, interest, and in some cases, collection activity. Always review the full cost of borrowing before committing.

Can I Extend or Roll Over My Payday Loan If I Can't Repay It on Time?

Some lenders may offer extensions or rollovers, which allow you to delay repayment by paying an additional fee. However, this often leads to a cycle of debt, as the interest continues to accrue. Rolling over a loan once or multiple times can double or even triple your repayment obligation. If you’re struggling to repay, it's best to contact the lender early and explore options, or seek help from a nonprofit credit counselor to avoid escalating costs.

Editorial Note

This article is provided solely for informational and entertainment purposes. Nothing within should be interpreted as legal, financial, or professional advice. Readers should carry out their own research before participating in payday loans.

Affiliate Transparency

This article may include affiliate links. If you click on a link and make a purchase or register, a commission may be earned, at no extra cost to you.

Syndication and Liability Disclaimer

Any third-party publishers, media platforms, or syndication partners that republish this content do so understanding that it’s meant for informational purposes only. These entities aren’t responsible for the legality, relevance, or interpretation of the material.

Contact

- Company: MoneyMutual

- Address: 2510 E. Sunset Rd. Ste 6, #85 Las Vegas NV, 89120

- Email: customerservice@moneymutual.com

- Phone Support: 844-276-2063

Attachment

Contact Company: MoneyMutual Address: 2510 E. Sunset Rd. Ste 6, #85 Las Vegas NV, 89120 Email: customerservice@moneymutual.com Phone Support: 844-276-2063

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.